Nassim Nicholas Taleb Quote

We do not need to be rational and scientific when it comes to the details of our daily life—only in those that can harm us and threaten our survival. Modern life seems to invite us to do the exact opposite; become extremely realistic and intellectual when it comes to such matters as religion and personal behavior, yet as irrational as possible when it comes to matters ruled by randomness (say, portfolio or real estate investments). I have encountered colleagues, rational, no-nonsense people, who do not understand why I cherish the poetry of Baudelaire and Saint-John Perse or obscure (and often impenetrable) writers like Elias Canetti, J. L. Borges, or Walter Benjamin. Yet they get sucked into listening to the analyses of a television guru, or into buying the stock of a company they know absolutely nothing about, based on tips by neighbors who drive expensive cars.

We do not need to be rational and scientific when it comes to the details of our daily life—only in those that can harm us and threaten our survival. Modern life seems to invite us to do the exact opposite; become extremely realistic and intellectual when it comes to such matters as religion and personal behavior, yet as irrational as possible when it comes to matters ruled by randomness (say, portfolio or real estate investments). I have encountered colleagues, rational, no-nonsense people, who do not understand why I cherish the poetry of Baudelaire and Saint-John Perse or obscure (and often impenetrable) writers like Elias Canetti, J. L. Borges, or Walter Benjamin. Yet they get sucked into listening to the analyses of a television guru, or into buying the stock of a company they know absolutely nothing about, based on tips by neighbors who drive expensive cars.

Related Quotes

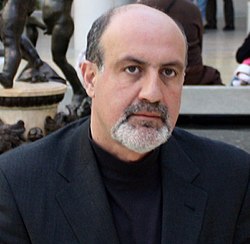

About Nassim Nicholas Taleb

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.