Nassim Nicholas Taleb Quote

Many amateurs believe that plants and animals reproduce on a one-way route toward perfection. Translating the idea in social terms, they believe that companies and organizations are, thanks to competition (and the discipline of the quarterly report), irreversibly heading toward betterment. The strongest will survive; the weakest will become extinct. As to investors and traders, they believe that by letting them compete, the best will prosper and the worst will go learn a new craft (like pumping gas or, sometimes, dentistry). Things are not as simple as that. We will ignore the basic misuse of Darwinian ideas in the fact that organizations do not reproduce like living members of nature—Darwinian ideas are about reproductive fitness, not about survival.

Many amateurs believe that plants and animals reproduce on a one-way route toward perfection. Translating the idea in social terms, they believe that companies and organizations are, thanks to competition (and the discipline of the quarterly report), irreversibly heading toward betterment. The strongest will survive; the weakest will become extinct. As to investors and traders, they believe that by letting them compete, the best will prosper and the worst will go learn a new craft (like pumping gas or, sometimes, dentistry). Things are not as simple as that. We will ignore the basic misuse of Darwinian ideas in the fact that organizations do not reproduce like living members of nature—Darwinian ideas are about reproductive fitness, not about survival.

Related Quotes

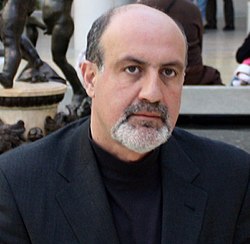

About Nassim Nicholas Taleb

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.