Nassim Nicholas Taleb Quote

Some can be more intelligent than others in a structured environment—in fact school has a selection bias as it favors those quicker in such an environment, and like anything competitive, at the expense of performance outside it. Although I was not yet familiar with gyms, my idea of knowledge was as follows. People who build their strength using these modern expensive gym machines can lift extremely large weights, show great numbers and develop impressive-looking muscles, but fail to lift a stone; they get completely hammered in a street fight by someone trained in more disorderly settings. Their strength is extremely domain-specific and their domain doesn't exist outside of ludic—extremely organized—constructs. In fact their strength, as with over-specialized athletes, is the result of a deformity. I thought it was the same with people who were selected for trying to get high grades in a small number of subjects rather than follow their curiosity: try taking them slightly away from what they studied and watch their decomposition, loss of confidence, and denial. (Just like corporate executives are selected for their ability to put up with the boredom of meetings, many of these people were selected for their ability to concentrate on boring material.) I've debated many economists who claim to specialize in risk and probability: when one takes them slightly outside their narrow focus, but within the discipline of probability, they fall apart, with the disconsolate face of a gym rat in front of a gangster hit man.

Some can be more intelligent than others in a structured environment—in fact school has a selection bias as it favors those quicker in such an environment, and like anything competitive, at the expense of performance outside it. Although I was not yet familiar with gyms, my idea of knowledge was as follows. People who build their strength using these modern expensive gym machines can lift extremely large weights, show great numbers and develop impressive-looking muscles, but fail to lift a stone; they get completely hammered in a street fight by someone trained in more disorderly settings. Their strength is extremely domain-specific and their domain doesn't exist outside of ludic—extremely organized—constructs. In fact their strength, as with over-specialized athletes, is the result of a deformity. I thought it was the same with people who were selected for trying to get high grades in a small number of subjects rather than follow their curiosity: try taking them slightly away from what they studied and watch their decomposition, loss of confidence, and denial. (Just like corporate executives are selected for their ability to put up with the boredom of meetings, many of these people were selected for their ability to concentrate on boring material.) I've debated many economists who claim to specialize in risk and probability: when one takes them slightly outside their narrow focus, but within the discipline of probability, they fall apart, with the disconsolate face of a gym rat in front of a gangster hit man.

Related Quotes

People lack morals, good moral character is important in every aspect of your life. Honesty and Integrity opens the door. Your character allows others to see you for who you truly are. Make your first...

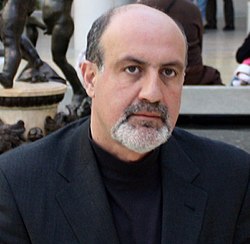

About Nassim Nicholas Taleb

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.