Nassim Nicholas Taleb Quote

Many people keep deploring the low level of formal education in the United states (as defined by, say, math grades). Yet these fail to realize that the new comes from here and gets imitated elsewhere. And it is not thanks to universities, which obviously claim a lot more credit than their accomplishments warrant. Like Britain in the Industrial Revolution, America's asset is, simply, risk taking and the use of optionality, this remarkable ability to engage in rational forms fo trial and error, with no comparative shame in failing again, starting again, and repeating failure.

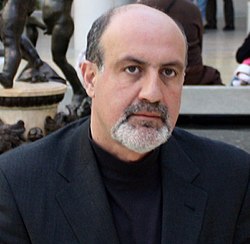

Nassim Nicholas Taleb

Many people keep deploring the low level of formal education in the United states (as defined by, say, math grades). Yet these fail to realize that the new comes from here and gets imitated elsewhere. And it is not thanks to universities, which obviously claim a lot more credit than their accomplishments warrant. Like Britain in the Industrial Revolution, America's asset is, simply, risk taking and the use of optionality, this remarkable ability to engage in rational forms fo trial and error, with no comparative shame in failing again, starting again, and repeating failure.

Related Quotes

About Nassim Nicholas Taleb

Nassim Nicholas Taleb (; alternatively Nessim or Nissim; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty.

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.