Nassim Nicholas Taleb Quote

More generally, we underestimate the share of randomness in about everything, a point that may not merit a book—except when it is the specialist who is the fool of all fools. Disturbingly, science has only recently been able to handle randomness (the growth in available information has been exceeded only by the expansion of noise). Probability theory is a young arrival in mathematics; probability applied to practice is almost nonexistent as a discipline. In addition we seem to have evidence that what is called courage comes from an underestimation of the share of randomness in things rather than the more noble ability to stick one’s neck out for a given belief. In my experience (and in the scientific literature), economic risk takers are rather the victims of delusions (leading to overoptimism and overconfidence with their underestimation of possible adverse outcomes) than the opposite. Their risk taking is frequently randomness foolishness.

More generally, we underestimate the share of randomness in about everything, a point that may not merit a book—except when it is the specialist who is the fool of all fools. Disturbingly, science has only recently been able to handle randomness (the growth in available information has been exceeded only by the expansion of noise). Probability theory is a young arrival in mathematics; probability applied to practice is almost nonexistent as a discipline. In addition we seem to have evidence that what is called courage comes from an underestimation of the share of randomness in things rather than the more noble ability to stick one’s neck out for a given belief. In my experience (and in the scientific literature), economic risk takers are rather the victims of delusions (leading to overoptimism and overconfidence with their underestimation of possible adverse outcomes) than the opposite. Their risk taking is frequently randomness foolishness.

Related Quotes

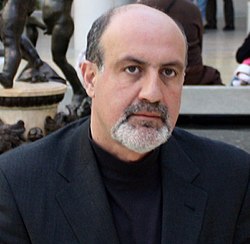

About Nassim Nicholas Taleb

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.