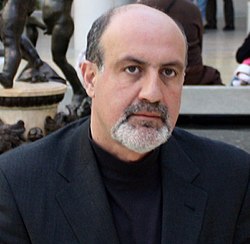

Nassim Nicholas Taleb Quote

I will repeat the following until I am hoarse: it is contagion that determines the fate of a theory in social science, not its validity.

Nassim Nicholas Taleb

I will repeat the following until I am hoarse: it is contagion that determines the fate of a theory in social science, not its validity.

Tags:

theory

Related Quotes

This theory [the oxygen theory] is not as I have heard it described, that of the French chemists, it is mine (elle est la mienne); it is a property which I claim from my contemporaries and from poster...

Antoine Lavoisier

Tags:

chemistry, discovery, french, invention, oxygen theory, posterity, science, scientific theory, scientist, theory

As Karl Marx once noted: 'Hegel remarks somewhere that all great, world-historical facts and personages occur, as it were, twice. He forgot to add: the first time as tragedy, the second as farce.' Wil...

Michael Shermer

Tags:

biology, creationists, evolution, facts, farce, g w hegel, hegel, history, intelligent design, john scopes

About Nassim Nicholas Taleb

Nassim Nicholas Taleb (; alternatively Nessim or Nissim; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty.

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.